Medicare Supplement Plan F

Medicare Supplement Plan F has been the most popular plan for many years because it offered the most comprehensive benefits. Starting January 1st 2020, new enrollees entering into Medicare will not be able to get a Plan F Medicare supplement. This is already starting to have negative effects to the rates for Plan F causing it to not be the most desirable plan any longer. If you have a Plan F already or are considering still looking into one, please give us a call at 866-319-5886 for a free consultation.

Plan F has been so popular over the years because it gave you the most “bang for your buck”. The whole point of Medicare supplements is to help reduce your out-of-pocket costs that are passed on to you from Original Medicare. Plan F is the only Medicare supplement that covers every one of those costs for you.

For those who are looking to have all of these costs covered and are willing to pay very high premiums, this will be the plan for you. In this article below we will go over in detail what exactly is covered and help you determine if Plan F is the right plan for you. Plan F is losing market share to Medicare Supplement Plan G, which is the second most comprehensive plan and is now the more “bang for your buck” plan.

Medicare Supplement Plan F Benefits

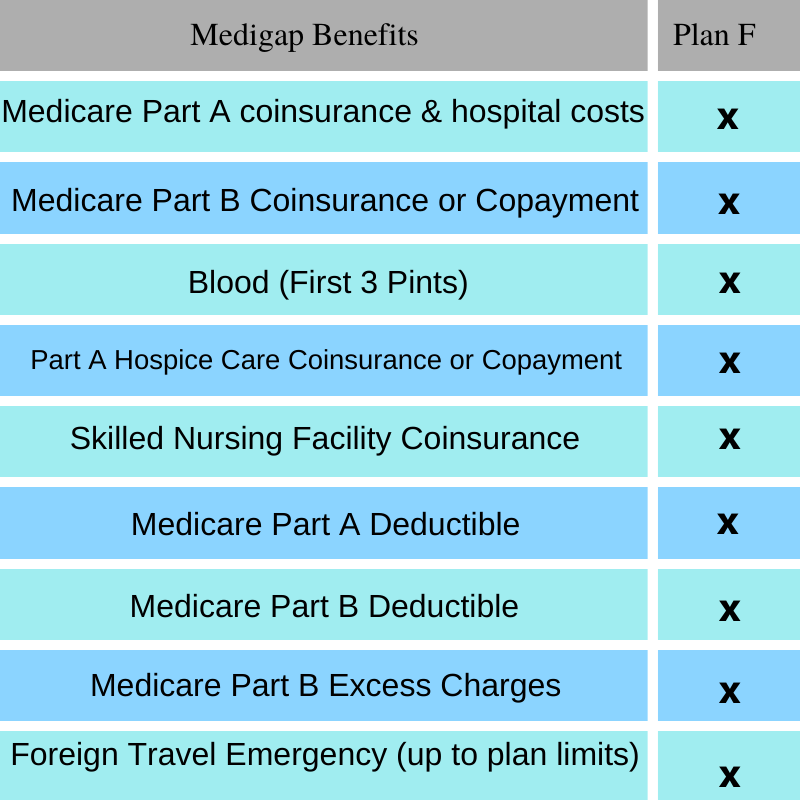

Plan F is currently the most comprehensive plan available for all Medicare eligible people. Plan F will cover all of the following for you:

- Medicare Part A Coinsurance & Hospital Costs (Up to an additional 365 days after Medicare benefits are exhausted)

- Medicare Part B Coinsurance or Copayment

- Blood (First 3 Pints)

- Medicare Part A Deductible

- Medicare part B deductible

- Medicare Part B Excess Charges

- Skilled Nursing Facility Coinsurance

Foreign Travel Emergency (Up to the plan limits)

Cost of Medicare Supplement Plan F

Remember that all Medigap plans are standardized, which means the benefits are the same no matter which company you choose to go with. Medigap Plan F is the plan that offers the most benefits but also comes with an expensive monthly premium. Costs vary depending on your location, age, sex and tobacco use when you are first entering Medicare.

While you want the best coverage, you will also want to consider that a Plan F will on average cost you close to $30 per month more than a Plan G Medicare supplement. The only benefit Plan F covers that Plan G does not is the $185 Part B Deductible. So, if you are paying $30 per month more for a Plan F that comes to a $360 higher annual cost for a Plan F but in return you are only getting a $185 benefit. This is a big reason why many people are looking at options outside of Plan F.

High Deductible Plan F

There is an alternative option that is called High Deductible Medigap Plan F. For the year of 2019 this means you would have to pay $2,300 out-of-pocket before the benefits of the plan begin. The high deductible plan will be cheaper because you are responsible for the first $2,300. Just like with most insurance, the plan will be cheaper when there is added financial responsibility on the beneficiary.

This may be a great option for anyone looking for the benefits of a Medicare supplement but are looking for a lower premium to meet their budget.

Should You consider Medigap Plan F?

While Medicare supplement Plan F is still a great plan and offers all the benefits a person could want, we do believe that there is a plan at this time that will better serve you. Give us a call at 866-319-5886 and we can go over any questions you have and help you choose the right medicare supplement for you. You can also fill out the form below and we will get in touch with you.